Compliance

Contractors and procured service providers must follow regulations set at the federal, state, and local levels. All needed compliance information can be found here. These standards are also reviewed in the Program Guidelines for each program.

Hiring and Labor Standards (DBRA, Section 3, MWSBE)

The Davis-Bacon and Related Act applies to all construction, alteration, and repair projects over $2,000 of public buildings or public works, where the United States or the District of Columbia is a party. Most projects funded by HCDD will also require compliance with Section 3 and Minority- and Women-Owned Small Business Enterprises (MWSBEs) requirements.

Harvey Multifamily Program projects must also comply to new guidelines set through a collaboration with Gulf Coast AFL-CIO, Workers’ Defense Project, Texas Organizing Project, and HOME Coalition. New worker protections are detailed in the Harvey Multifamily Program guidelines or explained on the Worker Protections page.

Key Information and Forms:

| Document Name | Description |

|---|---|

| Compliance Regulations: Davis Bacon, Section 3, and MWSBE | Program Standards are specific to Davis-Bacon and Related Acts and other federal labor standards |

| Compliance Forms: Davis Bacon and Federal Labor Standards | Standards and required forms specific to Davis-Bacon and Related Act and other federal labor standards |

| General Wage Determination Request | Form for requesting a General Wage Determination |

| Compliance Forms: Section 3 and MWSBE | Standards and required forms specific to Section 3 and MWSBE hiring standards |

| Section 3 Contractors Orientation Guide | Policy and procedures for becoming part of the Section 3 program |

| Section 3 Guide | Informational Brochure |

Looking to hire Section 3 residents or business concerns? Visit our Worker or Business directories.

Looking to become certified as a Section 3 resident or business concern? Apply on our main website . More opportunities for technical training and opportunities can be found on our main website .

Looking to hire MWSBEs? Visit the Office of Business Opportunity online MWDBE directory database maintained by the Office of Business Opportunity .

View the MWSBE Technical Assistance Training Presentation

- 24 CFR 125.32 - Regulations on Section 3

- HUD Section 3 Website

- HUD Section 3 Business Portal

- HUD Section 3 FAQs

For more information on Davis-Bacon and Related Acts, please visit:

Environmental Review

All federally funded projects must undergo a review process to measure the potential environmental impact of the project and to ensure that it meets federal, state, and local environmental standards. The environmental review process ensures that the project will not negatively impact the surrounding environment or health of end users. This review must be completed by an Environmental Review Officer from HCDD. During the environmental review process, environmental mitigation conditions may be identified for the project to meet local, state and federal requirements. These mitigation measures are required to be implemented to comply with HUD Environmental Requirements and will be monitored to ensure appropriate implementation. No funds may be spent on any HUD-related project that may have an adverse environmental impact or will limit the choice of reasonable alternatives.

For more information on federal requirements, refer to:

- 24 CFR Part 58 - Environmental Review Procedures for Entities Assuming HUD Environmental Responsibilities

- HUD Environmental Review Resources

- HUD Tiered Environmental Reviews Guidance

- HUD Web-Based Instructional System for Environmental Review

- Texas DSHS Asbestos Remediation Regulations

- HUD Lead Abatement Guidance

- Choice Limiting Actions

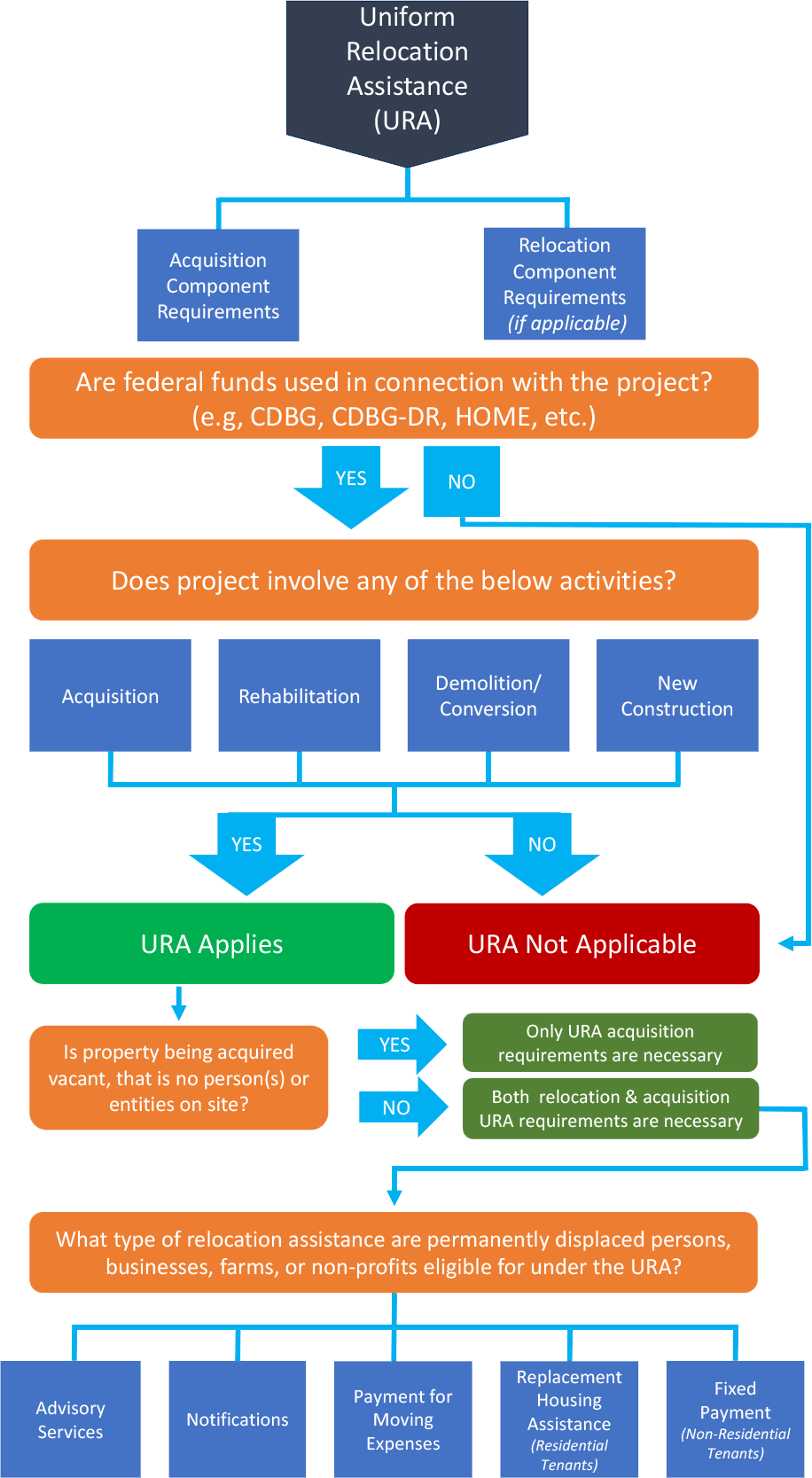

UNIFORM RELOCATION ASSISTANCE (URA)

All federally funded projects administered by HCDD must comply with the Uniform Relocation Assistance and Real Property Acquisition Policies Act of 1970, as amended (URA). The URA is applicable in cases where land acquisition, demotion, rehabilitation, and conversion of properties requires temporary relocation or permanent displacement of persons, businesses, farms, or non-profits.

Developers, agencies, and program staff should refer to our:

- Uniform Relocation Assistance and Real Property Acquisition Act of 1970, as amended URA Policy .

- Residential Anti-Displacement & Relocation Assistance Plan (RARAP)

For information and resources about the URA, please refer to the following tables:

URA APPLICABILITY FLOW CHART & FACT SHEETS

Acquisition and relocation activities require URA documentation. Some projects are acquisition only, involving vacant land or property with unoccupied structures. This type of project requires a minimal amount of URA compliance documentation. Projects involving the relocation of residential or nonresidential tenants require additional documentation.

| Document Name | Description |

|---|---|

| Acquisition & Relocation of Residential Tenant | List of URA Pre-requisite requirements for Residential Tenants |

| Acquisition & Relocation of Business Tenant | List of URA Pre-requisite requirements for Non-Residential Tenants |

| Acquisition & Relocation of Business Tenant | List of URA Pre-requisite requirements for Acquisitions only |

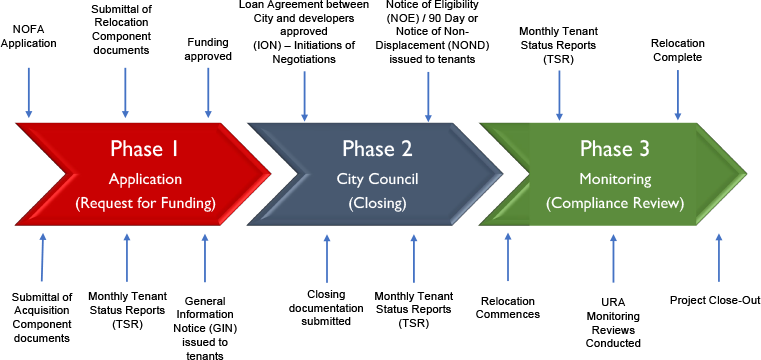

GENERAL URA PROJECT TIMELINE

Acquisition Component

| Document Name | Description |

|---|---|

| URA Assurances – Rv4- 04.2021 | Form executed by developers assuring URA compliance |

| Notice to Seller (Entities) - Rv3 -08.2021 | Form provided to property owners/ sellers indicating voluntary sale |

| Notice to Seller (Homebuyer) – Rv1 – 12.2019 | Form used by COH staff for Harvey Homebuyer Program |

| Sellers Occupancy Certification Form – Rv4 – 04.2021 | Form certifying occupancy status of property being purchased |

| Foreclosed Residential Property Occupancy Certification – Rv1 – 01.2020 | Only for residential housing units that were foreclosed |

| Notice of Interest (By Govt) – Rv5 – 04.2021 | Form used by COH when interested in purchasing property |

| Notice of Intent to Acquire – Rv1 – 11.2019 | Establishes eligibility for relocation assistance prior to commitment of federal financial assistance |

Relocation Component

| Document Name | Description |

|---|---|

| Guide to Develop a Relocation Plan | Resource used to aid in developing relocation plan |

| General Information Notice - Nonresidential Tenant Not Displaced | Template notification for temporary relocation of non-residential tenants |

| General Information Notice - Nonresidential Tenant To Be Displaced | Template notification for permanent displaced of non-residential tenants |

| General Information Notice - Residential Tenant Not Displaced | Template notification for temporary relocation of residential tenants |

| General Information Notice - Residential Tenant To Be Displaced | Template notification for permanent relocation of residential tenants |

| Move-In Notice | Notice provided to prospecting tenants wanting to move into a project after date of application assistance |

HUD information Brochures

| Document Name | Available Languages |

|---|---|

| Relocation Assistance to Displaced Businesses, Nonprofit Organizations – HUD-1043-CPD | English | Spanish |

| Relocation Assistance to Tenant From Their Home (Section 104(d)) – HUD -1365 CPD | English | Spanish |

| Relocation Assistance to Tenants Displaced From Their Homes (Section 104(d)) | English | Spanish |

Resources

URA Microlearning Module

Frequently Asked Questions (FAQs)

If you have any questions concerning URA, please contact our URA section by calling 832-393-0550 to be connected to a staff member.

Building and Floodplain Management Standards

All projects completed by City of Houston Contractors must meet the standards of the relevant program being discussed. The key documents in this table can be filtered by applicable program.

| Document | Program(s) | Download |

|---|---|---|

| Minimum Property Standards for Rehabilitation, Reconstruction, and New Construction | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

| Aging-In-Place Standards | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

| HUD Single-Family Housing Standards | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

| Lead-Based Paint and Asbestos-Containing Materials Requirements | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

| Single-Family Home Repair Construction Specifications | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

| City of Houston’s Code of Ordinances Chapter 19 – Flood Plain | Harvey Single Family Development Program; Harvey Homeowner Assistance Program | View |

Multifamily (Resources for Property Managers)

To ensure that properties we fund provide affordable homes for the long-term, HCDD monitors rental housing projects for compliance with rental requirements during the affordability period (according to 24 CFR 92.252). Our administrators and inspectors conduct onsite monitoring annually to verify accuracy of rent and occupancy reports, review onsite records, and inspect the property and rental units to ensure continued compliance with applicable housing standards per 24 CFR 92.504(d).

For information and resources about these standards, please visit:

- 24 CFR 92.252: Qualifications as Affordable Housing (Rental Housing)

- 24 CFR 92.504(d): On-Site Inspections and Financial Oversight

- Minimum Property Standards for Rehabilitation, Reconstructions, and New Construction

For verification of rent and occupancy, Property Managers will need to gather information from tenants using the below set of documents.

| Document Name | Description | Download |

|---|---|---|

| 2021 HOME Income Limits | Accepted income levels of applicants to HOME units | View |

| 2021 HOME Rent Limits | Maximum rents allowed for units funded through HOME | View |

| 2020 Allowance for Tenant - Furnished Utilities and Other Services | Allowance for tenant-furnished utilities and other services | View |

| Affidavit of Unemployment | Statement of unemployment, filled out by unemployed residents | View |

| Asset Verification | Statement of assets, filled out by residents who qualify for affordable units | View |

| Certification of Zero Income | Statement of zero income, filled out by residents with zero income | View |

| Child Support Affidavit | Statement verifying that residents are current on child support payments | View |

| Child Support Verification (CDBG) | Verification of child support income (submitted to Attorney General) for residents in CDBG-funded properties | View |

| Employment Verification | Verification of tenants’ employment status, filled out by employed residents | View |

| Income Contribution | Statement of contribution that resident will make to rent | View |

| Intake Application (CDBG) | Application for residents to live at CDBG-funded properties | View |

| Intake Application (HOME) | Application for residents to live at HOME-funded properties | View |

| Lease Addendum – Revised | Addendum that must be added to all lease contracts supported by the City of Houston | View |

| Pension Verification | Statement of pension, to be filled out by residents receiving pension payments | View |

| Rent Schedule (Blank) | Rent schedule for property | View |

| Social Security Benefit Verification | Statement verifying that resident receives Social Security payments | View |

| Substandard Housing Complaint – Form 2 | Form for residents wishing to file a complaint about a property | View |

| Sworn Assets (Under $5,000) | Form documenting assets of households who have less than $5,000 in combined assets | View |

| Telephone Verification | Form verifying an acceptable form of contact via telephone | View |

| Tenant Income Certification (pages 1-4) | Form documenting income that resident receives and will contribute to rent | View |

| Tenant Release and Consent | Form for tenant to release information about employment, income, and assets for the purpose of verifying information | View |

| Verification of Business Income | Statement verifying assets and income of a resident’s business | View |

| Veterans Benefit Verification | Statement verifying that resident receives Veterans Benefits | View |

Single-Family Long-Term Monitoring

Participants in our Harvey Homeowner Assistance Program and our Harvey Homebuyer Assistance Program must comply with the affordability period specified in their contracts. Some of our programs include a loan on the property for a duration outlined in their contract. To fulfill the terms of the contract, the homeowner must live in the home for the entire affordability period without selling, leasing, or transferring ownership of the property. At that point, a Release of Lien can be executed.

In the case that the homeowner decides to break the terms of the affordability period, they will need to repay the City some or all of their loan. For questions, please call us at 832-393-0550 and ask to speak to Loan Servicing.

Forms needed to be released from the loan can be found below:

| Document Name | Applicable to | Description | Download |

|---|---|---|---|

| Release of Lien Request | Homeowner | Form for requesting a release from the City’s loan on the property, either at the end of the affordability period or when choosing to repay the City before the end of the affordability period. | View |

| Payoff Statement Request | Title Company | Form for Title Company use only, to ask for payoff statement before the end of the affordability period. | View |

| Payoff Statement Request | Homeowner | Form for homeowner use only, to ask for payoff statement before the end of the affordability period. | View |

| Subordination Agreement Request | Title Company | Form to use when changing terms of mortgage. | View |

Fair Housing

The Fair Housing Act protects individuals and families from discrimination in the sale, rental, financing or advertising of housing based on their race, color, religion, family status, national origin, sex, or disability.

In the case of questions about rights of both tenants and landlords, please see this comprehensive guide . Upon request, we can also provide a hard copy of this booklet. To make a fair housing complaint, call our hotline at 832-394-6200, extension 5.